A funny thing happened to the minivan on the way to the scrap heap. Competition knocked out General Motors and Ford. But their retreat left three powerful players with high-volume minivans: Chrysler, Toyota and Honda.

The survivors get to split an ample 700,000-unit segment.

Minivan sales have collapsed in recent years because of all the alternatives: seven- and eight-seat SUVs, and now crossovers. But some people want and need a van.

"There aren't as many choices for minivans," says Randy Pflughaupt, Toyota Division group vice president of marketing. "There are fewer players and fewer options, but those that are left are pretty strong."

The overall segment continues to shrink in 2008--down 23.9 percent for the first two months of 2008. If trends continue, sales this year will be barely more than half of historical peak sales of 1,371,234 in 2000.

But the dip this year has a lot do with Chrysler's new strategy since introducing redesigned minivans last fall. Chrysler is running behind year-ago volume because it dropped the short-wheelbase Dodge Caravan, and the automaker has cut back sharply on less profitable sales to rental fleets.

"I'm pretty bullish on the segment," says Steven Landry, Chrysler executive vice president for North American sales. "It's not going to deteriorate that much."

What's more, the segment's survivors are commanding better minivan transaction prices. The average transaction has risen from $24,857 in the first quarter of 2003 to $27,500 in the first quarter of this year, according to Power Information Network.

Meanwhile, the same winds of fashion that took one-time minivan customers to mid-sized crossovers and SUVs could blow back the other way.

"We're not seeing minivans returning to the days of overall strength, but they still meet the needs of a lot of families," says Pflughaupt. "Our projections for the minivan segment are stable to where volume is right now."

Like Chrysler, Honda and Toyota minivan sales are down in 2008 compared to last year. But Honda and Toyota sell a lot more vans than they did in 2000, when the segment peaked. Their share of the segment has skyrocketed.

In 2000, Ford and GM combined for more than 575,000 minivan sales. Last year GM sold 78,376 units and Ford sold 3,090. The rest of the minivan segment, minus Ford and GM, is as big as ever.

Volkswagen will enter the minivan market this fall with the 2009 Routan, made by Chrysler at its Windsor, Ontario, assembly plant and based on the Chrysler minivans. But the Routan won't make up for the long list of entrants that have departed or are about to: the Buick Terraza, Oldsmobile Silhouette, Saturn Relay, Pontiac Montana SV6, Ford Freestar, Mercury Monterey and Mazda MPV.

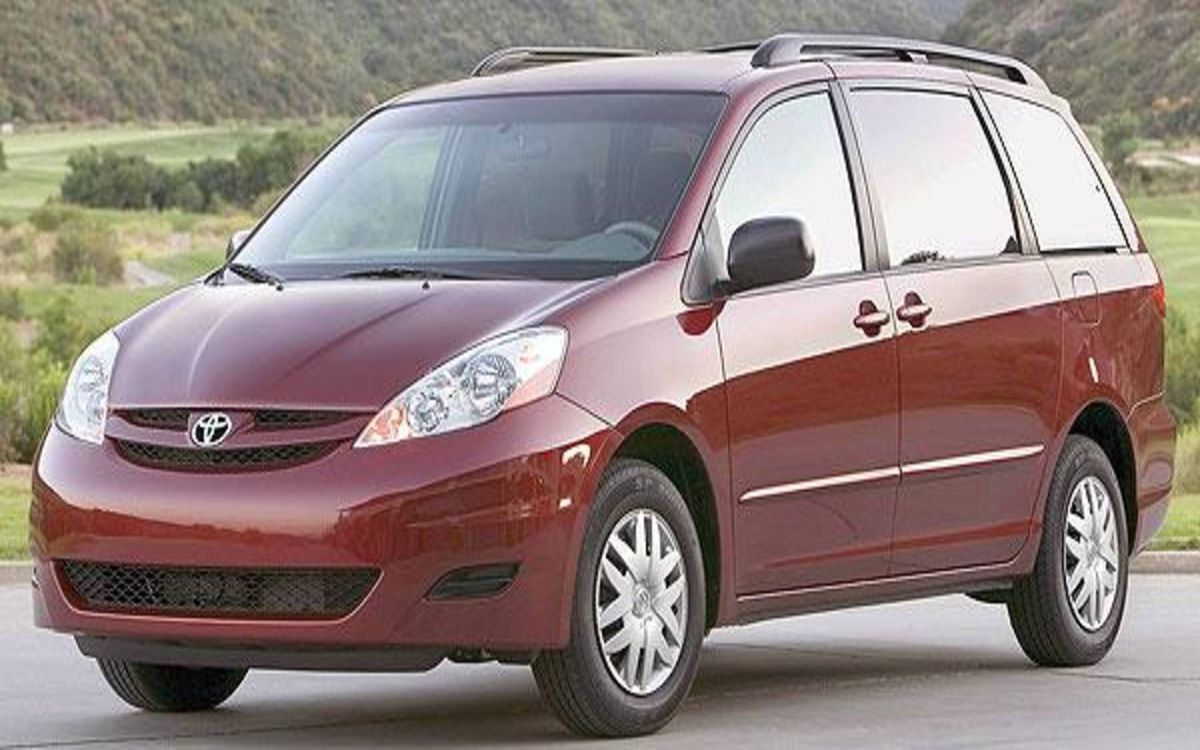

The rest of 2008 could see a dogfight for segment leadership. The Toyota Sienna is challenging Dodge's two-decade stranglehold on the sales crown. For the first two months of this year, the Sienna holds a 20.7 percent share, followed by the Chrysler Town & Country with 20.1 percent and the Honda Odyssey with 19.6 percent. The Dodge Grand Caravan has fallen to fourth with 18.4 percent. Dodge has led the field every year since 1996. Chrysler introduced the Dodge Caravan and Plymouth Voyager in 1983.

When sales of its two minivans are combined, Chrysler is still the leader with 38.5 percent of the minivan market, down slightly from the 38.9 percent share it held for all of 2007.

But the Chrysler Town & Country and Dodge Grand Caravan haven't hit their stride yet.

"We thought the Chrysler minivans would jump-start interest" in the segment, says Jesse Toprak, analyst at edmunds.com. "When the redesigned product hit the market last fall, that didn't happen."

Town & Country sales have fallen 9.4 percent for the first two months. But Dodge's minivans dropped 45.2 percent. Chrysler says its sales decline is exclusively because of the elimination of the short wheelbase, which was dominated by fleet sales.

"We lost a lot of sales by design when we dropped the short-wheelbase" Caravan, says Michael Accavitti, Dodge brand marketing director. "The customer for the short wheelbase wasn't the customer we were looking for to grow the business."

Jiyan Cadiz, Chrysler spokesman says: "So far through February, our retail minivan sales are up 8 percent, with over 1,000 new retail customers more than last year." Chrysler says its new models also are attracting younger buyers.

Chrysler also increased prices. Power Information Network data shows Town & Country transaction prices rose from $25,189 in 2007 to $28,632 in 2008, and Dodge prices went from $22,838 (combined Caravan and Grand Caravan) in 2007 to $25,259 for the Grand Caravan only. The prices were based on sales between Jan. 1 and March 16.

Dealers say customers are choosing pricier versions of the minivans.

Doug Alley, owner of Alley Chrysler-Dodge in Kingsport, Tenn., says he had enjoyed a good business selling short-wheelbase Caravans to budget-conscious customers. But customers were less eager to buy stripped-down versions of the 2008 Grand Caravan.

"I ordered some of those low-price Grand Caravans, but they've not done as well as the SXT with the DVD player," he said.

Like some other dealers, Alley noticed something else about the launch: "When they announced the new 2008 vans last spring, the Town & Country was out of the chute much faster. Somehow or another the Town & Country was ahead by two, three, four months in terms of ordering and getting inventory."

Chrysler says there was no problem with the Grand Caravan launch, but Landry acknowledges that the upscale packages on the Town & Country have been more popular with customers initially.

Toyota sales have declined the least of the three main players, down 1 percent compared to the first two months a year ago. Honda sales have dropped 13.2 percent.

Honda spokesman Chuck Schifsky says it's no surprise sales have slowed as customers watch for signs of economic recovery.

"People may be waiting to purchase until the economy gets shaken out," he said. "A minivan is less of an impulse buy. Minivan buyers have always been very practical shoppers."

When those practical buyers do return, they'll find three competitors eagerly waiting for their business.

Mark Rechtin contributed to this report